Lifestyle Creep Lifestyle Creep Is Perfectly Avoidable.

Lifestyle Creep. What Is The Definition Of Lifestyle Creep?

SELAMAT MEMBACA!

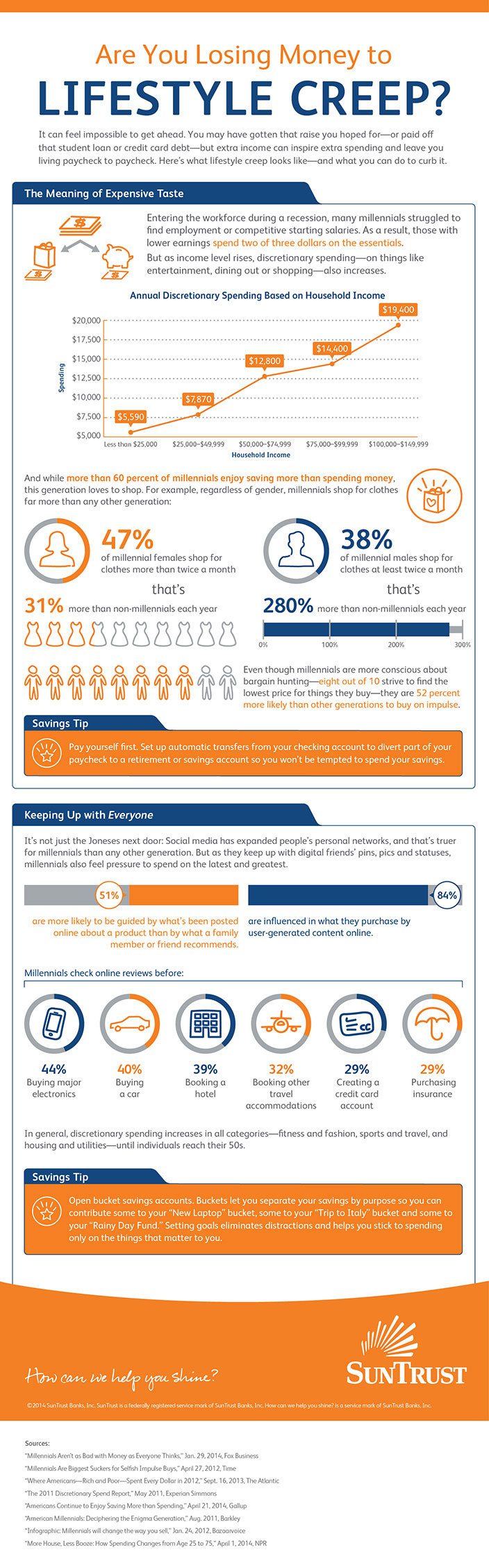

Lifestyle creep, also known as lifestyle inflation, is a phenomenon that occurs when as more resources are spent towards standard of living, former luxuries become perceived necessities.

Lifestyle creep occurs when an individual's standard of living improves as their discretionary income rises and former luxuries become new necessities.

Say hello to lifestyle creep.

Lifestyle creep, also known as lifestyle inflation, can sneak up on you and prevent you from building an emergency fund or properly saving for retirement.

It might be sabotaging your savings.

Save your budget—stop lifestyle creep before it strikes.

Lifestyle creep (ˈlīfˌstīl krēp), noun:

Lifestyle creep is when we increase our spending too much in response to income increases.

A conservative guideline is to save about 95% of any income increases from age 25 onwards.

Lifestyle creep is sneaky af.

It's intuitive, if you earn more, you can spend the creep alert graph shows spending that outpaces income growth, often fueled by the (reasonable) belief that you'll earn more the following year.

Lifestyle creep is the gradual increase of your spending as your wage increases.

You get a raise, so why not buy a new car?

Before you know it, you're paying for a gym membership you don't use, a truck you don't need, and a house that's too big.

Now, lifestyle creep isn't something everyone necessarily experiences, as it's important to not overgeneralize and assume everyone has felt this trap.

The good news about lifestyle creep is that it can be remedied and avoided in the future.

![How to Control Lifestyle Creep [The Silent Financial Trap]](https://investedwallet.com/wp-content/uploads/2019/08/Lifestyle-Creep.png)

Lifestyle creep refers to a condition where one's income rises or their bills decrease, and this creates a temptation for a lifestyle inflation.

Are you experiencing lifestyle creep?

If you have recently started to bring home more money, could you possibly be spending more than you should be?

It's generally related to making more without saving more while it's tempting to start spending any extra money you earn as soon as you, well, earn it, lifestyle creep can expose you and your family to a certain.

Lifestyle creep, or lifestyle inflation, is when an individual's standard of living increases as his or her discretionary income increases.

The rise can come from an increase in income, a decrease in expenses, or a combination of both.

Lifestyle creep is the gradual increase in your spending as your income increases.

Lifestyle creep is perfectly avoidable.

Knowing that it often stems from an increase in income helps.

Lifestyle creep is the financial trap, where you spend more money as you make more money.

September 4, 2020 by camilo maldonado.

Lifestyle creep happens to the best of us.

Your mindset is the key factor that will determine whether or not.

I think the best tool there is to manage my expenses is to have goals.

Before i started being serious with my.

It may just be a celebratory dinner after work — or it may be a riskier move to a pricey car loan.

You have the money, so what's the harm?

Lifestyle creep is the phenomenon that occurs when a person's spending increases as their income increases.

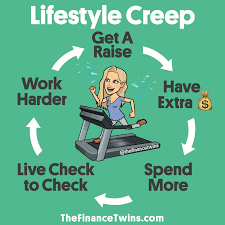

Lifestyle creep = as your income increases (through promotions, job changes, bonuses, etc.), your lifestyle also tends to increase (or creep up) in relation to your paycheck.

And that's exactly what happened to my friend.

As she started earning more money, she started buying things that cost more.

This frequently happens after getting a raise or paying off a monthly expense.

Lifestyle creep can come in many different shapes and sizes.

For some, it might be the desire to buy a more expensive car after receiving a promotion at how we avoid lifestyle creep.

Lifestyle creep becomes the default and can get us into trouble.

You can do both at the same time…responsibly.

Lifestyle creep refers to the unique phenomenon where as we make.

Lifestyle creep is when your lifestyle expenses and spending habits outpace and extend well beyond your income and the money you earn.

The end result isn't a good one for your financial plan — it can prevent you from building an adequate emergency fund and properly saving for your retirement.

What is the definition of lifestyle creep?

Lifestyle creep or lifestyle inflation is the phenomenon where the more money you earn, the more money you spend.

As your income increases, your lifestyle creep is when luxuries became a norm.

It's a slippery slope, but you can avoid it, and even come back from it.

It takes away from the things you truly love and replaces it with meaningless possessions.

Lifestyle creep is a net negative on your life.

It directs your wealth away from investment growth and into maintaining the stuff that doesn't truly make you happy.

*a situation where people's lifestyle or standard of living improves as their discretionary income.

As lifestyle creep occurs, and more money is spent on lifestyle, former luxuries are now considered necessities.

Awas, Bibit Kanker Ada Di Mobil!!8 Bahan Alami Detox Ternyata Salah Merebus Rempah Pakai Air MendidihSalah Pilih Sabun, Ini Risikonya!!!Resep Alami Lawan Demam AnakTernyata Inilah Buah Yang Bagus Untuk Menahan LaparMengusir Komedo Membandel - Bagian 2Ternyata Madu Atasi Insomnia4 Titik Akupresur Agar Tidurmu NyenyakTak Hanya Manis, Ini 5 Manfaat Buah Sawo*a situation where people's lifestyle or standard of living improves as their discretionary income. Lifestyle Creep. As lifestyle creep occurs, and more money is spent on lifestyle, former luxuries are now considered necessities.

Lifestyle creep occurs when an individual's standard of living improves as their discretionary income rises and former luxuries become new necessities.

An individual's discretionary income could increase as a result of increased income or decreased cost.

Say hello to lifestyle creep.

Lifestyle creep, also known as lifestyle inflation, can sneak up on you and prevent you from building an emergency fund or properly saving for retirement.

Lifestyle creep is when we increase our spending too much in response to income increases.

A conservative guideline is to save about 95% of any income increases from age 25 onwards.

For the median person making $57,000 a year, it sounds.

How to avoid lifestyle creep.

Keep them somewhere that you can refer back to often so you can track your progress.

Lifestyle creep is the gradual increase in spending as your income increases.

Lifestyle creep refers to the situation where someone gradually increases their spending on unnecessary items as their income and wealth increases.

Lifestyle creep is the financial trap, where you spend more money as you make more money.

You're basically playing yourself and robbing from your future.

Lifestyle creep refers to upping your spending after raising your income.

Here's how to stop it from compromising your savings and financial health.

3 tips to avoid lifestyle creep from compromising your finances after you get a raise.

You get a raise, so why not buy a new car?

This type of thinking can get you into trouble.

Before you know it, you're paying for a gym membership you don't use, a truck you don't need, and a house that's too big.

Axelrod's $2,000 hoodie and my road bike share one similarity:

It's intuitive, if you earn more, you can spend the creep alert graph shows spending that outpaces income growth, often fueled by the (reasonable) belief that you'll earn more the following year.

Lifestyle creep happens when your spending rises with your income and you adjust to a more expensive way of living.

Lifestyle creep can mean spending more on luxuries and saving less—here's how to avoid lifestyle creep and how to know if you're already caught up in it.

The danger of lifestyle creep is that it often goes unnoticed.

You may start off by rationalizing small purchases.

Lifestyle creep is the phenomenon that occurs when a person's spending increases as their income increases.

Lifestyle creep is a major factor in people never building true wealth or becoming financially independent.

It can be curtailed through budgeting and careful.

*a situation where people's lifestyle or standard of living improves as their discretionary income.

As lifestyle creep occurs, and more money is spent on lifestyle, former luxuries are now considered necessities.

Lifestyle creep or lifestyle inflation describes a situation where someone's disposable income increases due to an increase in pay or decrease in because lifestyle creep is a gradual process, you may not have realised that you have fallen prey.

Learn how lifestyle creep can stop you from saving money.

Lifestyle creep may sound like a term for someone who steals your most glamorous instagram photos, but it's actually a pattern where consumers spend more money on luxury expenses as their disposable income rises.

This phenomenon is called lifestyle creep.

It makes former luxuries — like designer jeans — seem like new necessities.

This is often what keeps.

Lifestyle creep is when you live on more than you make, making it hard to save, invest, and results in living paycheck to paycheck despite having a higher income.

Lifestyle creep or lifestyle inflation occurs when your standard of living improves with your income rising.

And what you might have seen as luxuries although i did mention some quick lifestyle creep examples above, i wanted to provide you with some more.

Many of these might resonate with you or.

Here's my experience with the lifestyle creep that came with getting a new job, and my tips for how to avoid the hedonic treadmill.

When most of us reach a certain point in our professional and personal finance journey, we start to experience lifestyle creep, the pressure to spend more.

Your normal lifestyle will creep up slowly and goods that were once seen as a luxury will gradually become a necessity.

Yet, lifestyle creep describes a very.

Proposer comme traduction pour creep.

Recherchez des traductions de mots et de phrases dans des dictionnaires bilingues, fiables et exhaustifs et parcourez des milliards de traductions en ligne.

Yet so few of us measure our spending, mostly because we're scared of what we'll discover.

Here's a free and customizable spreadsheet to track spending and expenses and mitigate lifestyle creep before it's too late.

Lifestyle creep, or lifestyle inflation, is something that many of us fall prey to without realising.

Before you know it, you're spending more on things that you once considered luxury items — like buying a new outfit.

The term refers to the gradual increase of your spending as your wage goes up. Lifestyle Creep. Before you know it, you're spending more on things that you once considered luxury items — like buying a new outfit.Black Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi LuwakPecel Pitik, Kuliner Sakral Suku Using BanyuwangiTernyata Bayam Adalah Sahabat WanitaTernyata Makanan Khas Indonesia Ini Juga Berasal Dari Tirai Bambu3 Jenis Daging Bahan Bakso TerbaikResep Cumi Goreng Tepung MantulBir Pletok, Bir Halal BetawiCegah Alot, Ini Cara Benar Olah Cumi-CumiBuat Sendiri Minuman Detoxmu!!Resep Beef Teriyaki Ala CeritaKuliner

Komentar

Posting Komentar